African national oil companies (NOCs) partnering with independents to drive E&P

Oil & Gas 360º

MARCH 10, 2025

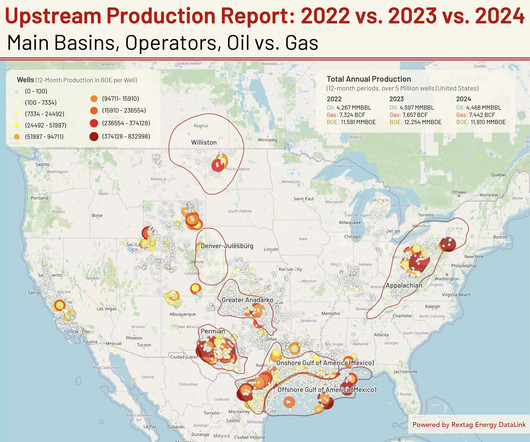

These efforts reflect a broader trend across the continent, where NOCs are leaning on foreign partnerships to advance oil and gas production. Advancing gas monetization Amid a surge in gas monetization, Africa has emerged as a major LNG producer. Algerias Sonatrach will increase hydrocarbon production by 2.5%

Let's personalize your content