Louisiana Supreme Court holds that payment of mineral royalties judgment against LDNR is a matter of legislative discretion, reversing grant of mandamus

The Energy Law

FEBRUARY 28, 2023

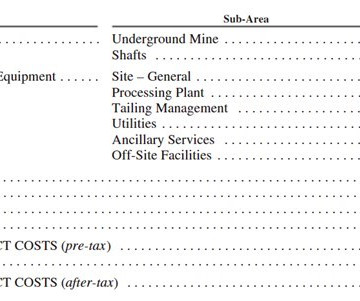

million judgment for reimbursement of mineral royalties. million in mineral royalties attributable to ownership of these banks. The Court distinguished those cases, pointing to constitutional and statutory provisions that mandate appropriation under those specific circumstances. 1/1/23), So.

Let's personalize your content