IS THE FREEWAY IN SIGHT?

Oil and Gas Investments

FEBRUARY 15, 2025

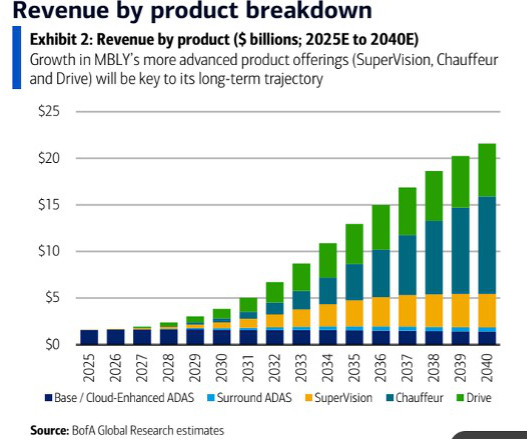

A commute where I can read a book, the family napping on vacation to arrive rested at the destination, even just getting out at the front door while the car finds its own parking spot. SELF-EDUCATING ON SELF-DRIVING My introduction to self-driving cars came from a deep-dive into what became a portfolio holding, Arteris (AIP – NASDAQ).

Let's personalize your content