Energy Transfer Makes FID on Permian Basin Pipeline

Rigzone: News

DECEMBER 9, 2024

The large-diameter pipeline, previously called the Warrior Pipeline, will be renamed the Hugh Brinson Pipeline.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Permian Basin Oil and Gas Magazine

MARCH 11, 2025

Findlay, Ohio-based MPLX said recently it agreed to acquire the remaining 55 percent interest in BANGL pipeline system from affiliates of Midlands Diamondback Energy and WhiteWater for $715 million. The post MPLX to acquire remaining interests in BANGL pipeline from Permian to Gulf appeared first on Permian Basin Oil and Gas Magazine.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Oil Gas Leads

MARCH 8, 2025

The Permian Basin continues to be a driving force behind U.S. Heres a breakdown of what was said about the companys investments and outlook for the basin. Heres a breakdown of what was said about the companys investments and outlook for the basin. oil and gas production, and ONEOK Inc. Bcf/d in 2025.

Energy Central

SEPTEMBER 18, 2024

The Matterhorn Express Pipeline, due to begin service in September, will significantly increase natural gas pipeline capacity in the Permian Basin, according to a new analysis from the U.S. Energy Information Administration.

McKinsey

NOVEMBER 30, 2018

Gas production is starting to exceed pipeline capacity exiting the Permian, and in-basin prices are falling as a result. Paradoxically, the second problem is a potential overreaction to the first problem: market fundamentals could attract too many pipelines, and the Permian runs the risk of having underutilized pipelines.

Energy Central

FEBRUARY 1, 2022

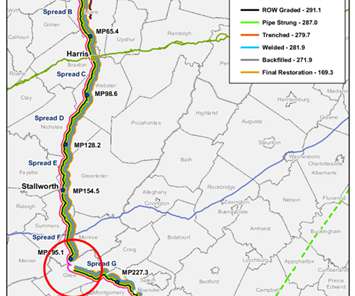

Circuit Court of Appeals decision to revoke a permit for Mountain Valley Pipeline, the Appalachian Basin and the United States are currently facing the consequences of delaying this critical energy project. While environmental activists like Wild Virginia celebrate the 4th U.S. Further delays will only hamper U.S.

Oil & Gas 360º

MARCH 6, 2025

The bid round is expected to attract foreign investors and drive exploration activities across Libyas resource-rich basins, enabling global energy companies to engage in a market that has remained largely unexplored for nearly two decades.

Permian Basin Oil and Gas Magazine

MARCH 7, 2025

20 it completed its new Greenwood II plant in Midland Basin (275 million cfd) and its new Train 10 fractionator in Mont Belvieu (120,000 b/d). Also Targa recently commenced operations of its Bull Moose plant (275 million cfd) and front-end treater (800 million cfd) in Delaware Basin. Targa said Feb. billion to $2.8

Rextag

OCTOBER 29, 2024

The rapid growth of natural gas production in the Permian Basin is pushing existing infrastructure to its limits, and additional pipeline projects are on the horizon to meet rising demand, according to East Daley Analytics. Beginning operations in early October, the pipeline can transport up to 2.5 Bcf/d of natural gas.

Oil Gas Leads

MARCH 10, 2025

Leading companies are aggressively expanding and integrating their gathering, processing, pipeline, and export infrastructure. This “Wellhead to Water” strategy is particularly evident in the Permian Basin, where crude oil, natural gas, and natural gas liquids (NGLs) production is growing rapidly. energy production growth.

Rextag

JANUARY 27, 2025

Kinder Morgan has unveiled plans to construct the Trident Intrastate Pipeline, a $1.7 The pipeline will have a capacity of 1.5 July 2024 : WhiteWater Midstream announced the Blackcomb Pipeline, a 2.5 Bcf/d capacity project connecting the Permian Basin to the Agua Dulce hub. Trident project is proof of that.

Oil Gas Leads

MARCH 11, 2025

The Permian Basin continues to solidify its role as the driving force behind U.S. Enterprise Products Partners LP , a leading midstream operator, is taking a strategic approach to expansion , focusing on pipeline investments, LNG and LPG exports, and securing fee-based revenue to ensure long-term stability. oil and gas production.

Permian Basin Oil and Gas Magazine

MARCH 1, 2025

Policies Aim to Support Supply Expansion : The incoming administration plans to ease regulations, expand access to federal leases, and streamline permits for wells, pipelines, and LNG exports. Related: O&G Outlook for 2025 The post Energy Trends for 2025 appeared first on Permian Basin Oil and Gas Magazine. 1) Pro-Growth U.S.

Energy Transfer

FEBRUARY 12, 2025

This was primarily due to higher throughput and higher rates across our Gulf Coast and Mariner East pipeline operations and we also had strong NGL exports and increased profits from the optimization of hedged NGL inventory. The increase was primarily due to increased gains related to pipeline and storage optimization opportunities.

Aresco

OCTOBER 25, 2023

Key Processes: Transportation via pipelines, rail, trucks, or ships; storage in tanks or other facilities; and marketing for wholesale distribution. Assets: Midstream assets include pipelines, storage tanks, terminals, and transportation infrastructure. It bridges the gap between the upstream and downstream sectors.

Energy Transfer

NOVEMBER 19, 2024

We are already seeing increasing power needs across several of our natural gas pipelines driven by AI, data center and power plant growth. Given our extensive natural gas pipeline network, particularly in Texas and Oklahoma, we believe that Energy Transfer is one of the best positioned companies in the industry to help meet this demand.

Rextag

DECEMBER 23, 2024

billion Date: October 11, 2024 ExxonMobil made waves by acquiring Pioneer Natural Resources, securing 850,000 net acres in the Permian Basin. Occidental Petroleums Acquisition of CrownRock Value: $12 billion Date: March 2024 Occidental acquired CrownRocks 70,000 acres in the Permian Basin, adding 50,000 boe/d to its production.

Energy Transfer

OCTOBER 18, 2024

Our 2023 Corporate Responsibility Report highlights our successes, including our operational results, pipeline safety programs, risk management, and emissions reduction programs, among others. billion in organic growth projects, including an eighth fractionator at Mont Belvieu NGL Complex and a new processing plant in the Permian Basin.

Oil & Gas 360º

MARCH 10, 2025

The collaborationamongthe three companies would leverage in-basin natural gas production, advanced energy generation via fuel cell technology, and infrastructure financing to create a highly efficient, scalable, and sustainable energy solution tailored for the rapid expansion of data center power capacity requirements.

Rextag

DECEMBER 18, 2024

In the first part of this series, we explored the massive pipeline projects that crisscrossed the U.S., Led the development of the Chad-Cameroon Pipeline and spearheaded deepwater drilling projects in the Gulf of Mexico. BP (British Petroleum) Central to the success of the BTC Pipeline, which diversified Europes oil supply routes.

Energy Transfer

MARCH 12, 2025

Energy Transfers Hugh Brinson Pipeline is also expected to be the premier option to support power plant and data center growth in Texas. The pipeline will deliver natural gas from the Permian Basin to major markets and trading hubs throughout Texas. The natural gas supply is expected to generate approximately 1.2

Rextag

JANUARY 21, 2025

Limited access to core acreage in basins like the Permian has prompted landmark deals, including ExxonMobils acquisition of Pioneer Natural Resources and Chevrons purchase of Hess Corporation. PERMIAN BASIN: OPTIMIZING RECOVERY IN A MATURE PLAY The Permian Basin , a cornerstone of U.S. Currently, at $2.75/MMBtu,

Aresco

MARCH 13, 2025

AI models analyze real-time data from drilling sites, pipelines, and refineries, adjusting operations to optimize production and efficiency. AI-powered systems can fine-tune extraction techniques, monitor pipeline integrity, and adjust refinery processes to maximize output while reducing the risk of inefficiencies.

Energy Transfer

DECEMBER 10, 2024

According to just-released data from the Environmental Protection Agency, methane emissions across all major oil and gas basins in the U.S. In fact, the No. 1 reason carbon emissions have decreased in the U.S. Methane emissions have also plunged. have fallen 44 percent since 2011. Also of note are advancements U.S.

Oil Gas Leads

MARCH 10, 2025

Gas drilling activity could increase in response to a projected rise in gas prices, potentially benefiting gas-heavy basins like the Marcellus and Haynesville. Key Takeaways The rig count decline is modest , suggesting a more stable period after recent additions.

Producer's Edge

JANUARY 20, 2025

Pioneer Natural Resources USA, Inc. ("Pioneer"), a natural gas producer operating in the Permian Basin, entered into a firm contract with MIECO, L.L.C. ("MIECO"), an energy trading firm. ” Section 11.2:

Drillers

MARCH 24, 2020

Pipeline vandalism, militant attacks on infrastructure, protests and lawsuits are among the issues that have plagued Nigerias oil industry for years. For many, stealing crude oil from the pipelines and processing it at one of the many illegal refineries in the region is a means of earning a living. million BPD as of November 2019.

Valor

FEBRUARY 24, 2025

Read more 25% royalty rate cap on prime oil and gas land heads to the House Summary : The New Mexico Senate passed Senate Bill 23 in a 21-15 vote, advancing legislation to raise the maximum royalty rate on prime oil and gas land in the Permian Basin from 20% to 25%. energy exports.

Oil Gas Leads

MARCH 8, 2025

Phillips 66 is making big moves in the Permian Basin , a critical hub for U.S. During their Q4 2024 earnings call , the company outlined how strategic acquisitions, processing expansions, and pipeline investments will drive growth in their Midstream business and position them to capitalize on rising NGL and crude demand.

Rextag

OCTOBER 31, 2024

Despite this trick rather than treat, ExxonMobil boosted production by 80,000 oil-equivalent barrels daily, driven by growth in the Permian Basin and Guyana. Adjusted profits rose by 15.6%, thanks to increased natural gas liquid volumes flowing through its extensive pipeline network.

Oil Gas Leads

MARCH 11, 2025

Energy Transfer’s latest earnings call highlighted record-breaking production in the Permian Basin, strategic midstream and pipeline investments, and surging global demand for LNG, LPG, and NGL exports. Permian Basin: Unprecedented Growth Driving Midstream Expansion The Permian Basin continues to be the dominant driver of U.S.

Rextag

FEBRUARY 24, 2025

Now, as we step into 2025 , the industry faces critical questions : Which basins will see the most growth? oil & gas basins , the leading companies , and market trends using the latest data and forecasts. However, in late 2024, the Matterhorn Express pipeline came online, adding 2.5 We analyze major U.S. 2023 Production: ~6.0

Oil Gas Leads

MARCH 13, 2025

natural gas production, particularly in the Haynesville Basin, as domestic gas prices surge. Haynesville Basin: The Right Time to Ramp Up The Haynesville Basin, located in eastern Texas and northwestern Louisiana, has long been a critical natural gas-producing region. BP is doubling down on its U.S.

Energy Transfer

DECEMBER 23, 2024

It was another exciting and successful year for Energy Transfer and Sunoco, with everything from impactful acquisitions and a major pipeline deal to sports sponsorships and record-breaking donations. The new large-diameter pipeline, previously called the Warrior Pipeline, will now be known as the Hugh Brinson Pipeline.

Oil & Gas 360º

MARCH 10, 2025

The combined company becomes the largest Canadian light oil focused producer and the seventh largest producer in the Western Canadian Sedimentary Basin, with significant natural gas growth potential. times net debt/funds flow, which is expected to continue to further strengthen to 0.8

Marcellus Shale Coalition

FEBRUARY 26, 2025

In 2015, then-Massachusetts Attorney General Maura Healey released a report asserting that no new natural gas pipelines were needed into the region and that the regions power grid faced no reliability deficiency through at least 2030. All was fine, said the Attorney General. A reality the Governor’s constituents are now forced to face.

Rextag

FEBRUARY 3, 2025

That single revelation was enough to rattle the markets, sending shares of natural gas producers, pipeline operators, and power plant owners into a steep selloff. Pipeline giants Kinder Morgan and Williams Cos. Traders, fearing a potential shift in AIs energy consumption needs, dumped stocks in a frenzy. and 8.4%, respectively.

Valor

JANUARY 27, 2025

Read more Will Trump’s executive order revive the Keystone XL pipeline? Summary : President Trumps recent executive order reverses the cancellation of the Keystone XL pipeline permit, opening the door for its potential revival. However, the pipelines developer, South Bow Corp., continuing to lead the merged entity.

Aresco

NOVEMBER 18, 2024

energy production faced challenges from restrictions on federal land leases, the revocation of key pipeline projects, and limitations on exports. Meeting Energy Demand and Supporting National Interests Beyond the financial incentives, Trumps energy policies are expected to revive American energy independence, supporting U.S.

Valor

FEBRUARY 17, 2025

Double Eagle controls over 95,000 net acres in the Midland Basin portion of the Permian Basin, making it one of the largest private equity holdings in the region. This move follows Diamondback’s recent $26 billion acquisition of Endeavor Energy Resources, reflecting its strategy to expand its presence in the Permian Basin.

Aresco

NOVEMBER 7, 2024

The Future of Keystone XL The Keystone XL pipeline, a significant project under Trumps first term, was set to bring Canadian oil to American refineries, support job creation, and secure a stable supply of North American oil.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content