Strategies for Operators to Stay Ahead in a Hot M&A Market

Enverus

MARCH 10, 2025

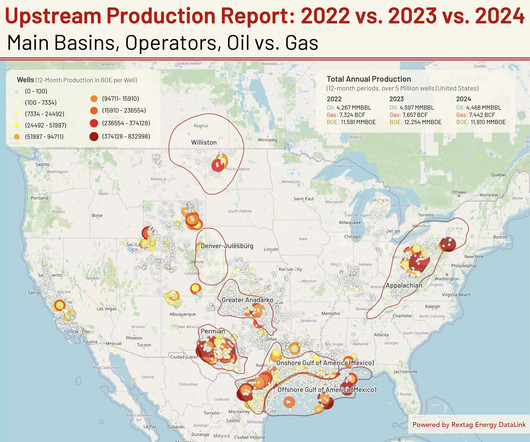

upstream M&A reaching $105 billion in 2024the third highest as recorded by Enverusthe market shows no signs of slowing down, with high price tag deals being driven by the scarcity of high-quality inventory. Diamondback is one of the largest players in the Permian Basin, second only to Exxon Mobil, based on gross operated oil volumes. [1]

Let's personalize your content