From Wellhead to Water: How Midstream Companies Are Shaping the Future of Energy Exports

Oil Gas Leads

MARCH 10, 2025

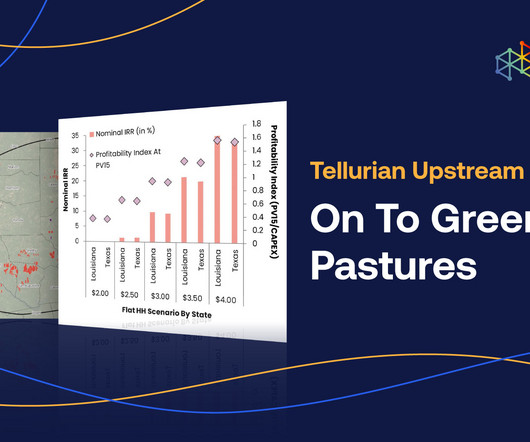

The midstream energy sector is undergoing a transformative shift. This “Wellhead to Water” strategy is particularly evident in the Permian Basin, where crude oil, natural gas, and natural gas liquids (NGLs) production is growing rapidly. ” Energy Transfer (ET) Who Are the Key Players? .”

Let's personalize your content