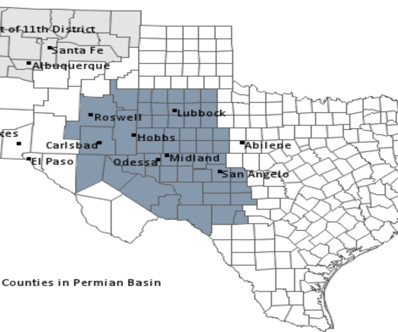

ONEOK’s Expanding Footprint in the Permian Basin

Oil Gas Leads

MARCH 8, 2025

The Permian Basin continues to be a driving force behind U.S. oil and gas production, and ONEOK Inc. Heres a breakdown of what was said about the companys investments and outlook for the basin. Heres a breakdown of what was said about the companys investments and outlook for the basin. Bcf/d in 2025.

Let's personalize your content