Why Oil Prices Have Dropped

Energy Central

AUGUST 12, 2024

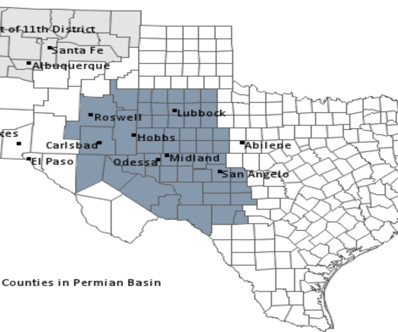

a barrel to below $75.00 The most recent driver is the negative sentiment pervading the stock market, which has extended its. Over the past month, the price of West Texas Intermediate (WTI) has fallen from about $85.00 Concerns about weaker demand from China have negatively impacted oil prices for a while, and now fears of a U.S.

Let's personalize your content