From Wellhead to Water: How Midstream Companies Are Shaping the Future of Energy Exports

Oil Gas Leads

MARCH 10, 2025

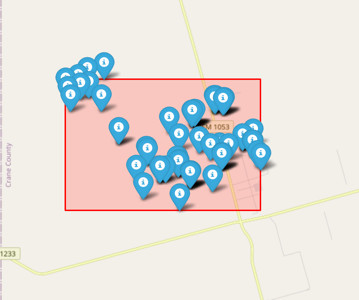

The midstream energy sector is undergoing a transformative shift. This “Wellhead to Water” strategy is particularly evident in the Permian Basin, where crude oil, natural gas, and natural gas liquids (NGLs) production is growing rapidly. “The producers in the Permian Basin need it desperately. Why the Permian?

Let's personalize your content