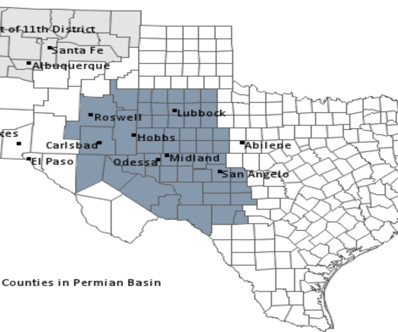

Permian Basin Economic and Energy Update: Q4 2024

Oil Gas Leads

MARCH 4, 2025

A combination of rising energy prices, stable production, and economic expansion has positioned the region as a key driver of the U.S. per barrel , marking a 5.2% per barrel of oil equivalent (boe) , up 15.6% million barrels per day (bpd) , reflecting a 1.3% oil and gas sector. increase compared to the third quarter.

Let's personalize your content