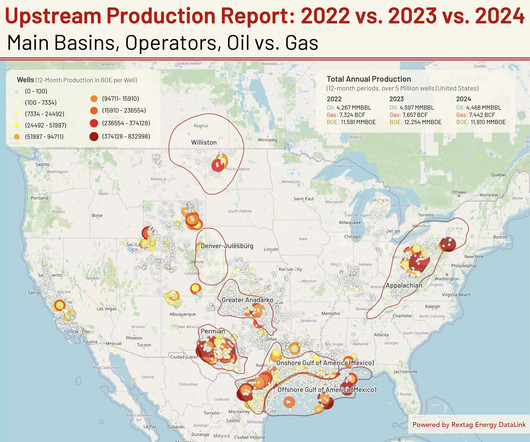

Upstream Production Report: 2022 vs. 2023 vs. 2024 – Main Basins, Operators, Oil vs. Gas

Rextag

MARCH 11, 2025

This report analyzes upstream oil and gas production trends over the last three years, based on data from Rextag Energy DataLink. in 2024. in 2024 , indicating a return to growth. State Oil (MMBBL) Gas (BCF) Texas 1,240 MMBBL 1,377 BCF New Mexico 493 MMBBL 391 BCF Pennsylvania 2.41 in 2023 , then increasing by 1.3%

Let's personalize your content