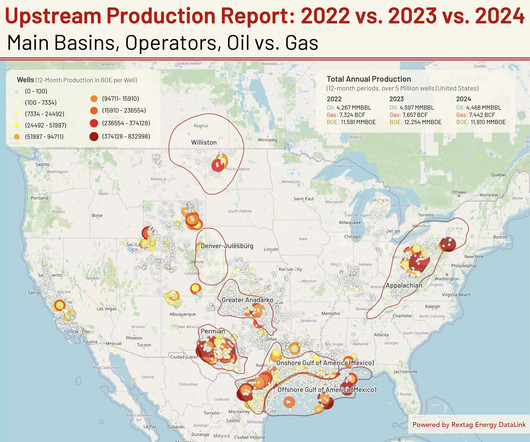

Upstream Production Report: 2022 vs. 2023 vs. 2024 – Main Basins, Operators, Oil vs. Gas

Rextag

MARCH 11, 2025

It covers total production figures, performance by key operators, and state-level contributions, focusing on key basins such as the Permian Basin, Appalachian Basin, Denver-Julesburg (DJ) Basin, Onshore and Offshore Gulf of America (Mexico), Williston Basin, and Greater Anadarko Basin. in 2023 compared to 2022 but recovered slightly by 0.4%

Let's personalize your content