Energy Market Assessment: Restoring upward mobility of the masses will have a profitable oil & gas drilling boom

Oil & Gas 360º

MARCH 11, 2025

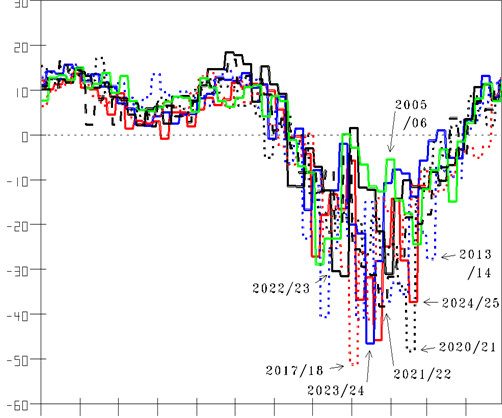

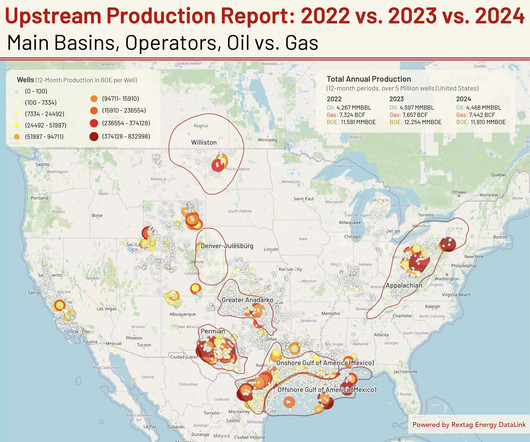

Energy Market Assessment: Restoringupward mobility of the masses will have a profitable oil & gas drilling boom- oil and gas 360 While many are worried about stock market volatility, interest rates, tariffs and other uncertainty, The Climate Changing to stimulating is driving our bullish natural gas outlook. Figure 9: U.S.

Let's personalize your content