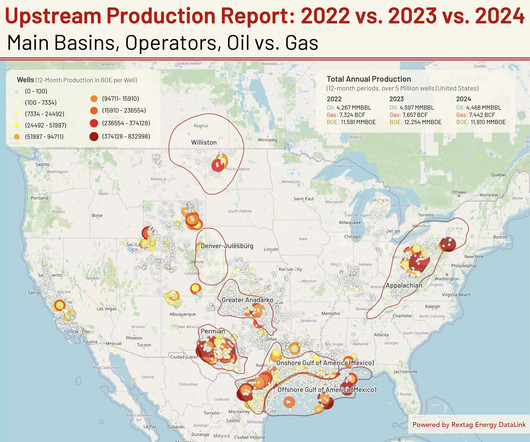

Upstream Production Report: 2022 vs. 2023 vs. 2024 – Main Basins, Operators, Oil vs. Gas

Rextag

MARCH 11, 2025

This report analyzes upstream oil and gas production trends over the last three years, based on data from Rextag Energy DataLink. in 2023 compared to 2022 but recovered slightly by 0.4% in 2023 , then increasing by 1.3% in 2023 , then increasing by 1.3% in 2023 , before rising by 0.7% in 2024.

Let's personalize your content