Strategies for Operators to Stay Ahead in a Hot M&A Market

Enverus

MARCH 10, 2025

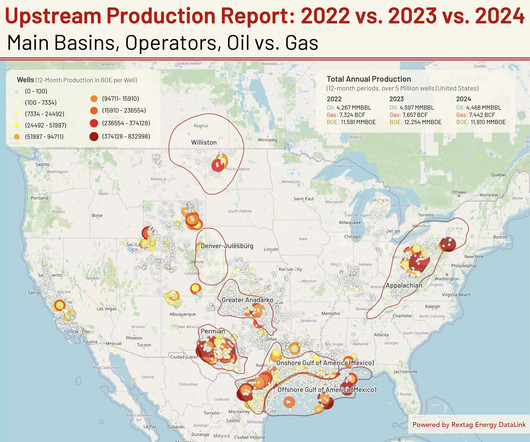

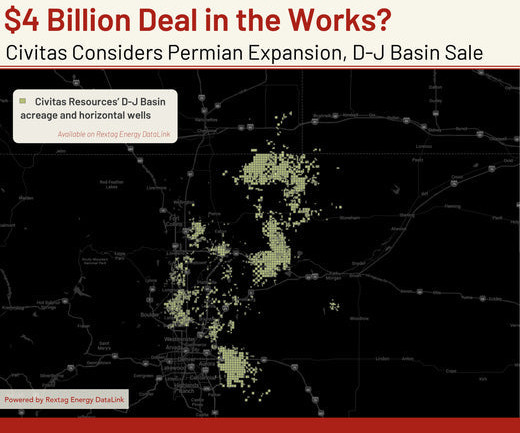

Diamondback is one of the largest players in the Permian Basin, second only to Exxon Mobil, based on gross operated oil volumes. [1] Although the recent Diamondback deal sets a new benchmark at $7 million per location, exceeding a comparable 2023 Permian deal of OXY’s CrownRock acquisition at $4.8 million per location. [2]

Let's personalize your content