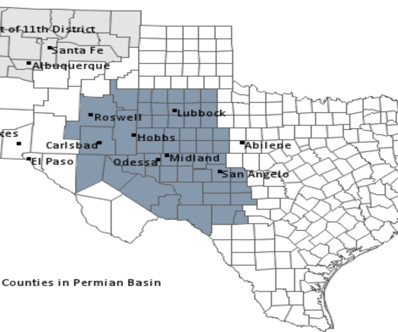

SM Energy reports record proved reserves, including 34 percent in Midland Basin

Permian Basin Oil and Gas Magazine

MARCH 4, 2025

million barrels (80,200 barrels per day) up 23 percent from 2023. million boed (170,000 boed) up 12 percent from 2023. Estimated net proved reserves at yearend 2024 were 673 million barrels of oil equivalent, including 51 percent in south Texas, 34 percent in Midland Basin and 15 percent in Uinta Basin.

Let's personalize your content