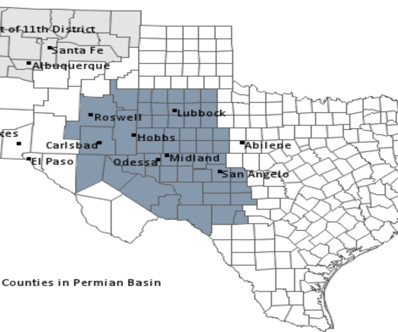

Permian Basin Economic and Energy Update: Q4 2024

Oil Gas Leads

MARCH 4, 2025

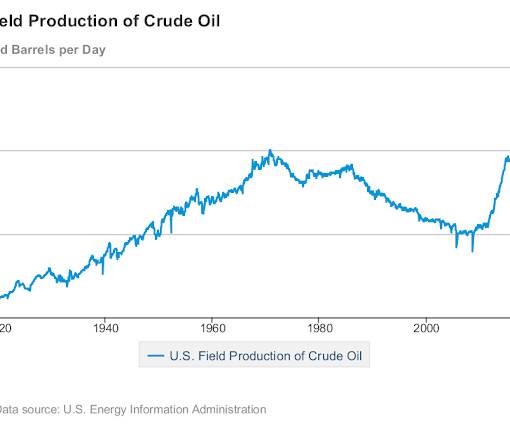

The Permian Basin continues to demonstrate resilience and growth as we close out the fourth quarter of 2024. oil and gas sector. Below, we analyze the latest data on oil and gas prices, production, labor market trends, and the housing sector. The price of West Texas Intermediate (WTI) crude oil closed the quarter at $71.72

Let's personalize your content