Wasted Gas, Wasted Royalties – How Common-Sense Climate Policy Can Put Money Back in People’s Pockets

Energy Central

FEBRUARY 19, 2024

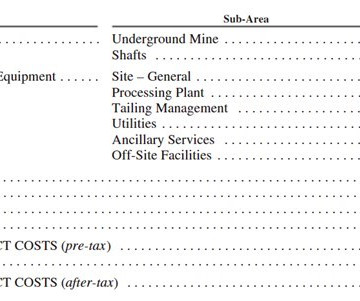

By EDF Blogs By Aaron Wolfe, Ari Pottens , and Scott Seymour EDF economic analysis found that in 2022 oil and gas operators across Alberta wasted $671 million in natural gas, costing the provincial government over $120 million in lost royalties and uncollected corporate taxes.

Let's personalize your content