Louisiana Legislature to Consider Amendments to Forced Pooling Regime Requiring Operators to Pay Lessors of Nonparticipating Working Interest Owners Directly

The Energy Law

APRIL 4, 2023

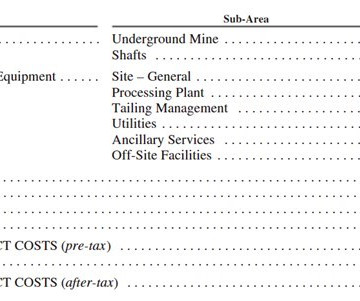

While 30:10 was amended during the 2022 legislative session, the amendment preserved the limited obligation of remitting the royalty and overriding royalty burdens to the nonparticipating owner for the benefit of the royalty and overriding royalty owners.

Let's personalize your content