Energy Market Assessment: Restoring upward mobility of the masses will have a profitable oil & gas drilling boom

Oil & Gas 360º

MARCH 11, 2025

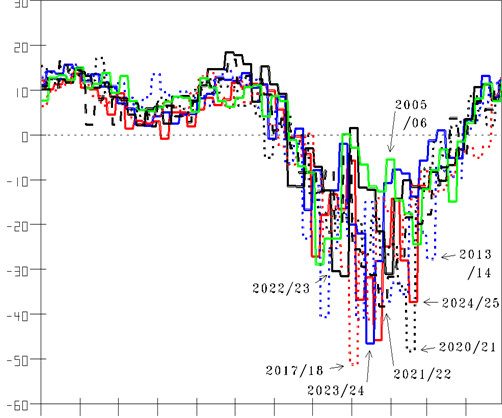

(Oil & Gas 360) – Switching Back To An Employer-Driven Economy (From Ruler-Driven) Restoring Upward Mobility Of The Masses Will Have A Profitable Oil & Gas Drilling Boom. Last weeks 80 Bcf draw in working natural gas inventory has it down at 1,760 Bcf on February 28 (Figure 9, red line).

Let's personalize your content