Tellurian Upstream Sale: On To Greener Pastures

Novi

MAY 31, 2024

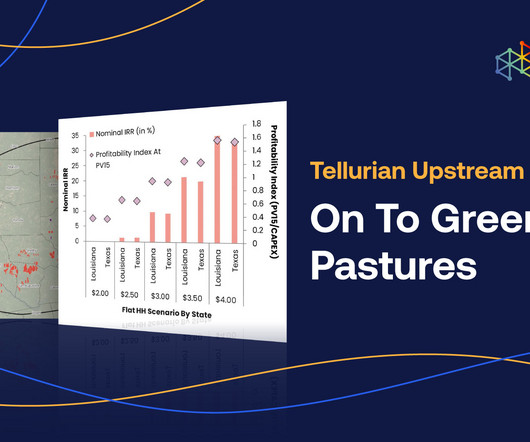

Aethon has agreed to purchase Tellurians upstream assets for (US) $260MM below street estimates, which ranged from $270MM to $500MM. Despite the market’s dislike of the purchase price, Tellurians upstream assets were in the middle of the pack. Basin-wide, however, ~$3.00/Mcf Basin differentials are assumed to be ~0.25/Mcf,

Let's personalize your content